Personal loans have entirely taken over the loan sector and there are many compelling reasons for this. Personal loans are becoming more popular since they do not need any collateral, need minimal documentation, have quick disbursal and simple eligibility criteria. Among all the advantages of a personal loan, we will focus on personal loan eligibility today.

Before applying for an online loan, it is essential to review the qualifying conditions of your lending institution. The eligibility requirements are usually available on your lender’s website or loan app. When you examine closely, you’ll notice that the eligibility requirements centre on your age, citizenship, occupation, and monthly income.

Eligibility is vital in your loan journey since it is the first obstacle you must overcome. For your convenience, we have included a checklist of personal loan qualifying requirements that you should review before applying for a personal loan.

Have a look at the list of personal loan eligibility:

Your Age

When you apply for a personal loan, the first thing mentioned in the eligibility criteria will be your age. Usually, the age criteria for a personal loan range from 21 to 58. The reason behind it is that most of the people in that age group belong to working-class individuals. A working-class individual is more likely to make repayment of their loan on time as they are financially independent and have a fixed monthly income.

Your Citizenship

This one is rather simple to grasp. Personal loan providers only offer loans to those who have Indian citizenship. This is due to the fact that all personal loan rules and restrictions apply to Indian residents. Each nation has its own regulations regarding personal loans, which residents must observe.

Your Occupation

Personal loan lenders consider three types of employment categories – salaried, self-employed and professional. Due to their better level of economic security compared to self-employed and salaried applicants, lenders offer salaried applicants personal loans at cheaper interest rates. Government workers are the most favoured candidates for salaried positions, followed by MNCs and reputable corporations. Professionals such as CAs, physicians, lawyers, architects, etc. are more likely to receive loans at lower interest rates when applying for personal loans granted to self-employed candidates.

Work Experience

Your work experience also matters when applying for an online loan. Salaried employees must have a minimum of 2 years of combined work experience, with at least 6 months of that experience coming from their current employer. Self-employed people and professionals often need to show stability in their present business for at least two years to qualify for an unsecured personal loan. To prove your job experience, you must present a few documents attesting to your claim.

Minimum Income

Higher-income suggests a greater ability to make on-time loan repayments, which further suggests a lesser risk for lenders. Most lenders establish a minimum salary threshold of Rs. 15,000 or more for salaried professionals. Keep in mind that lenders prefer borrowers with a minimum salary of Rs 25,000. Lenders often demand a gross yearly income of Rs. 2 lakh or more from self-employed people. It should be noted that certain lenders have not made their minimum wage or monthly income criteria for personal loan applicants publicly available. In such cases also you can follow the minimum income range we have provided in this post.

Your Credit Score

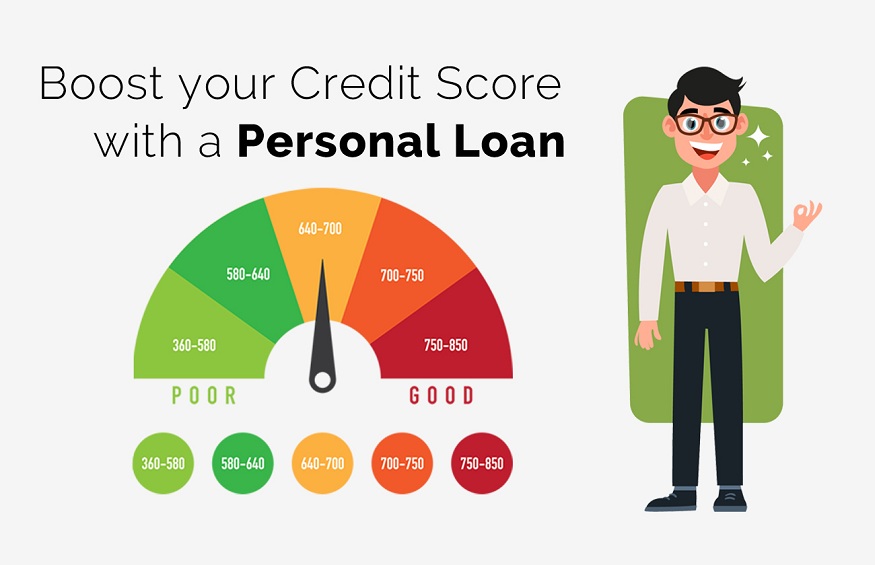

As a personal loan is an unsecured loan, the only factor through which a lender can decide to lend you is your credit score. Individuals with a higher credit score are thought to be more financially responsible and hence less likely to default. As a result, banks and NBFCs favour providing personal loans to these individuals.

For candidates for personal loans with better credit ratings, many lenders also charge reduced interest rates. However, some lenders also provide personal loans at higher interest rates to applicants with poorer credit ratings. So, you should maintain a good credit score. Some of the best ways to improve your credit score are by making timely repayment of your loans, not missing any due date, avoiding too much debt at the same time, and choosing a different form of credit.

Your Repayment Capacity

This point may not be exclusively mentioned in your lender’s list of eligibility criteria, but it still plays a significant role. Lenders typically approve personal loans to borrowers with EMI/NMI ratios of no more than 50% to 55%, however, this can vary amongst lenders. This suggests that their total monthly loan payments—including those for the proposed loan—should not equal more than 50% of their gross income.

Conclusion

So, before you apply for a personal loan, we strongly advise you to carefully review this list of eligibility criteria. Previously, you had to go to your bank with all of your documentation and have the lender determine if you were eligible to apply for a personal loan or not. However, with advancements in the loan and banking sectors, you may now apply for a loan online. The best thing about an online loan is that you can acquire all of the information you need in just a few clicks and in case you are not found eligible for it, you may enhance your profile and reapply at anytime from anywhere.